Physical Address

23,24,25 & 26, 2nd Floor, Software Technology Park India, Opp: Garware Stadium,MIDC, Chikalthana, Aurangabad, Maharashtra – 431001 India

Physical Address

23,24,25 & 26, 2nd Floor, Software Technology Park India, Opp: Garware Stadium,MIDC, Chikalthana, Aurangabad, Maharashtra – 431001 India

The Role of green financing

There is a famous quote from Barak Obama, which is most suitable to address green financing, “Money is not the only answer, but it makes a difference”. Green financing refers to providing financial support and investment for projects and initiatives that are environmentally sustainable and contribute to mitigating climate change.

Green financing involves directing capital towards positive environmental impacts, such as renewable energy projects, energy efficiency improvements, sustainable infrastructure, and other initiatives that reduce greenhouse gas emissions and promote sustainable development.

As discussed during the UAE pre-session of the 28th UN international conference on climate change, more attention has been driven to this.

President-designated COP 28, Dr Sultan Ahmed Al Jabar, says at the summit, “To make financing more accessible, we need to simplify, speed up and standardise access to climate funds across international financial institutions and specialised funds.” This statement is very timely. It highlighted that to make financing more accessible, the world must work together, and also long-term projects that need to address climate change and prevent the adverse effects of immediate disasters require a quick and transparent financial system. There are several aspects and mechanisms of green financing. Let’s consider those and how they act on climate change issues.

Green Financing Aspects and Mechanisms

Green bonds are a more critical and essential factor in this case, which means fixed-income financial instruments. It is specifically designed to raise capital for projects with environmental benefits. The proceeds from these bonds are exclusively used to fund environmentally friendly projects, such as renewable energy installations, energy-efficient buildings, sustainable agriculture, and clean transportation systems. There are several types of green bonds. Let’s consider them one by one.

Climate Funds is a word you are familiar with, but many people need to learn the meaning. Climate funds are established by governments, international organisations, and private entities to provide financial resources for climate change mitigation and adaptation projects. These funds support initiatives related to renewable energy deployment, climate resilience, reforestation, and sustainable land use, among others.

Sustainability-Linked Loans – Financial instruments where the interest rate is tied to the borrower’s sustainability performance. Borrowers receive financial incentives, such as lower interest rates, if they achieve predetermined sustainability targets, such as reducing greenhouse gas emissions, improving energy efficiency, or enhancing waste management practices. Many companies, especially the local and international tourism industry, follow up on this sustainability linked loan that is a catchy worthy system.

Next, the Green venture capital firms focus on providing funding and support to startups and companies developing innovative solutions for climate change mitigation and environmental sustainability. These investments help accelerate the growth and adoption of clean technologies, renewable energy solutions, and sustainable business models.

Impact Investing is angel investors. Impact investors seek financial returns while also generating positive environmental and social outcomes. They invest in companies, funds, and projects demonstrating measurable positive impacts on climate change, such as clean energy generation, sustainable agriculture, waste reduction, and access to clean water and sanitation.

Carbon Markets- It is a familiar word. We have already discussed this before. Carbon markets have two mechanisms: cap-and-trade systems or carbon offset mechanisms, which create a financial value for reducing greenhouse gas emissions. Companies that emit carbon dioxide can buy carbon credits or offsets from projects that reduce or remove emissions, providing financial incentives for emission reduction efforts. However, there is a negative side to this also. Please read our article for more information.

Carbon Trading, A Solution for Climate Change?

Up to now, we discussed the aspects and mechanisms of green financing. Let’s consider how Sri Lanka uses green financing to mitigate climate change.

Green Finance in Sri Lanka

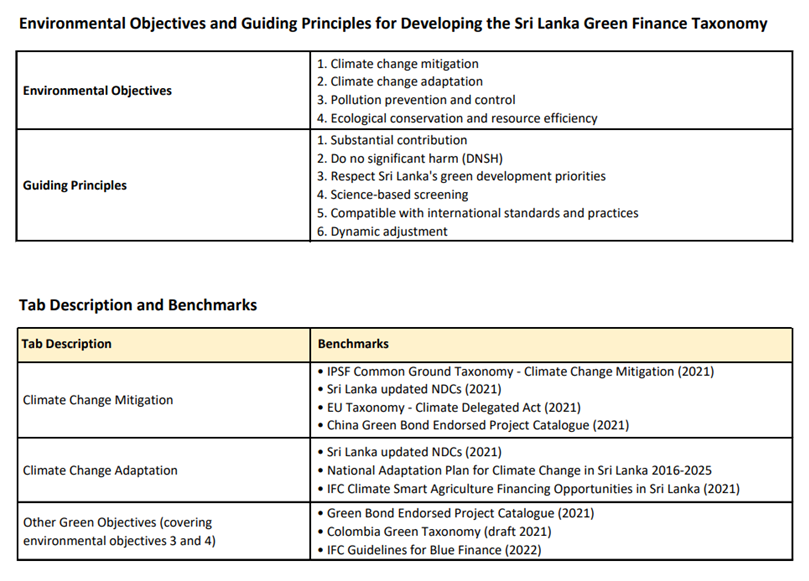

The Sri Lanka Green Finance Taxonomy is a classification system which defines and categorises economic activities that are environmentally sustainable and is a crucial action item outlined in the Roadmap for Sustainable Finance of Sri Lanka introduced by the Central Bank in 2019. Let’s take a look at country’s objective and bench market options.

Visit for more info – Green finance taxonomy by Central Bank Sri Lanka.

Central Bank of Sri Lanka categorised green financing methodologies into sectors such as Agriculture, Transportation and storage, Manufacturing, construction, Tourism and recreation, Water supply, sewerage and waste management, ICT, etc. So, in brief, some they have to include Research and development and application of green prevention/ control products, Plastic recycling, remanufacturing and repurposing, Use of renewable energy technologies in buildings, Wastewater treatment of significant industries and use of seawater, Application of information systems, technology, and instruments deployed for measuring, tracking, and reporting physical and chemical indicators to achieve sustainable goals.

How can Sri Lanka Survive green financing with the pandemic and economic crisis?

The conference on Sustainable Green Financing in Sri Lanka, “Promoting Green Finance for Sustainable Recovery from the Impact of Pandemic”, follows up the adoption of the 2030 Agenda to meet sustainable development goals. ESCAP recently estimated the annual additional investment required in the developing countries of Asia and the Pacific at US$1.5 trillion annually. So, you can imagine how global eyes are focused on this case since it should recover soon.

Over the past years, the COVID-19 pandemic has brought an unprecedented socio-economic crisis to the region and, after that, an economic crisis which required outstanding policy responses. These policy measures necessarily increase fiscal expenditure, but financing them remains a significant challenge.

One example of a policy option is for governments to leverage domestic and foreign private finance, such as by issuing sovereign bonds, including green or sustainable bonds, to countries with low to moderate risk of external debt distress, like Sri Lanka. More can be read here

In a nutshell

Green financing is crucial in addressing climate change by mobilising resources to support the transition to a low-carbon economy. Governments, financial institutions, and international organisations are taking active steps to promote green financing. Through these mechanisms, capital flows are redirected towards climate-friendly projects, fostering the transition to a more sustainable and resilient economy in the face of climate change.

If you have any queries or come across suspicious content related to climate change or the environment and want us to verify them for you, then send them to us on our WhatsApp hotline: +917045366366