Physical Address

23,24,25 & 26, 2nd Floor, Software Technology Park India, Opp: Garware Stadium,MIDC, Chikalthana, Aurangabad, Maharashtra – 431001 India

Physical Address

23,24,25 & 26, 2nd Floor, Software Technology Park India, Opp: Garware Stadium,MIDC, Chikalthana, Aurangabad, Maharashtra – 431001 India

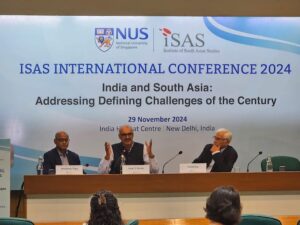

In a stark warning about the growing threats posed by climate change, Reserve Bank of India (RBI) Deputy Governor Rajeshwar Rao emphasized the urgent need for the financial system to address climate risks, which could potentially cause systemic disruptions. Speaking at a conference organized by the National University of Singapore in New Delhi, Rao highlighted the significant risks climate change poses to the economy, businesses, and financial stability.

The deputy governor outlined two key types of climate-related risks that financial institutions and the broader economy face: physical risks and transition risks. Physical risks stem from the increasing frequency and intensity of climate events such as floods, hurricanes, and heat waves, which can directly damage assets and disrupt business operations. Transition risks, on the other hand, arise from the economic shifts associated with transitioning to a low-carbon economy, such as changing regulations, technological advancements, and shifts in market preferences. These risks create considerable uncertainty for firms and investors.

Rao highlighted the growing challenges of managing these risks, warning that their effects could lead to business disruptions, increased loan losses, and systemic instability if not adequately addressed.

Data Gaps and Methodological Challenges

One of the central challenges in assessing and managing climate risks, according to Rao, lies in the lack of comprehensive and reliable data. He pointed out the absence of uniform methodologies, fragmented accessibility of critical information, and a lack of historical data on loan losses linked to climate hazards.

“We are yet to comprehensively assess climate risks due to data issues. These include fragmented accessibility, differing metrics, and a lack of historical loan loss data and hazard forecasts,” Rao explained.

The deputy governor also noted that the technical limitations and institutional constraints in India make it difficult to tap into the global pool of private funds for climate finance. Without addressing these data gaps, he warned, it would be challenging to set up effective projects aimed at coping with the impact of climate change.

Balancing Mitigation and Adaptation

While acknowledging the importance of transitioning to a low-carbon economy, Rao cautioned against overlooking the immediate impacts of climate events. He argued that adaptation measures, which are crucial for minimizing the risks and damages caused by climate-related events, are currently underemphasized in many climate strategies.

“While transitioning is crucial, we cannot overlook the immediate impact of climate events. We also need to look at adaptation measures, which currently appear to be a missing link in climate strategies,” he said.

Unlike mitigation projects—which focus on reducing greenhouse gas emissions to slow down climate change—adaptation projects aim to minimize the risks and damages caused by climate-related events such as extreme weather, rising sea levels, and changing rainfall patterns. Adaptation measures are particularly crucial for countries like India, which are highly vulnerable to the physical risks of climate change.

The Financial System’s Catalytic Role

Rao stressed the need for the financial system to play a catalytic role in addressing climate risks and overcoming the challenges they pose. This includes not only mobilizing funds for both mitigation and adaptation projects but also developing frameworks to assess and manage climate risks comprehensively.

“The financial system needs to address climate risks urgently and play a catalytic role in overcoming related challenges,” he said, adding that collective action was essential to mitigate the increasing risks posed by climate change.

The deputy governor highlighted that climate risks could have far-reaching impacts on the economy, society, and financial stability. For instance, physical risks could lead to widespread asset damage and business disruptions, while transition risks could result in stranded assets and increased uncertainty for investors. Together, these risks could exacerbate loan defaults and undermine financial institutions’ resilience.

Tapping Global Climate Finance

Rao also pointed out the difficulties India faces in accessing international climate finance, despite the urgent need for funding to combat climate change. He identified several barriers, including data gaps, technical limitations, and institutional constraints, which hinder the country’s ability to design and implement effective climate projects.

To address these challenges, Rao called for greater collaboration between the public and private sectors, as well as enhanced international cooperation to facilitate the flow of funds for climate adaptation and mitigation projects. He emphasized that tackling these barriers was essential for India to build resilience against the adverse effects of climate change.

References:

Photo by ISAS https://x.com/ISASNus/status/1862668564337238379/photo/4

Banner Image: Photo on X by Institute of South Asian Studies (ISAS) – NUS